A company might be registered as a VAT payer in its country (locally), but that does not automatically mean that the company is also a VAT payer in the EU. It is advisable to always check your customer / supplier VAT validity, because it may impact final VAT reporting and taxation.

Table of contents

Validate EU VAT ID status step by step

European Union VAT numbers are stored in VIES (VAT Information Exchange System). It enables companies to obtain confirmation of the VAT numbers of their trading partners

1.

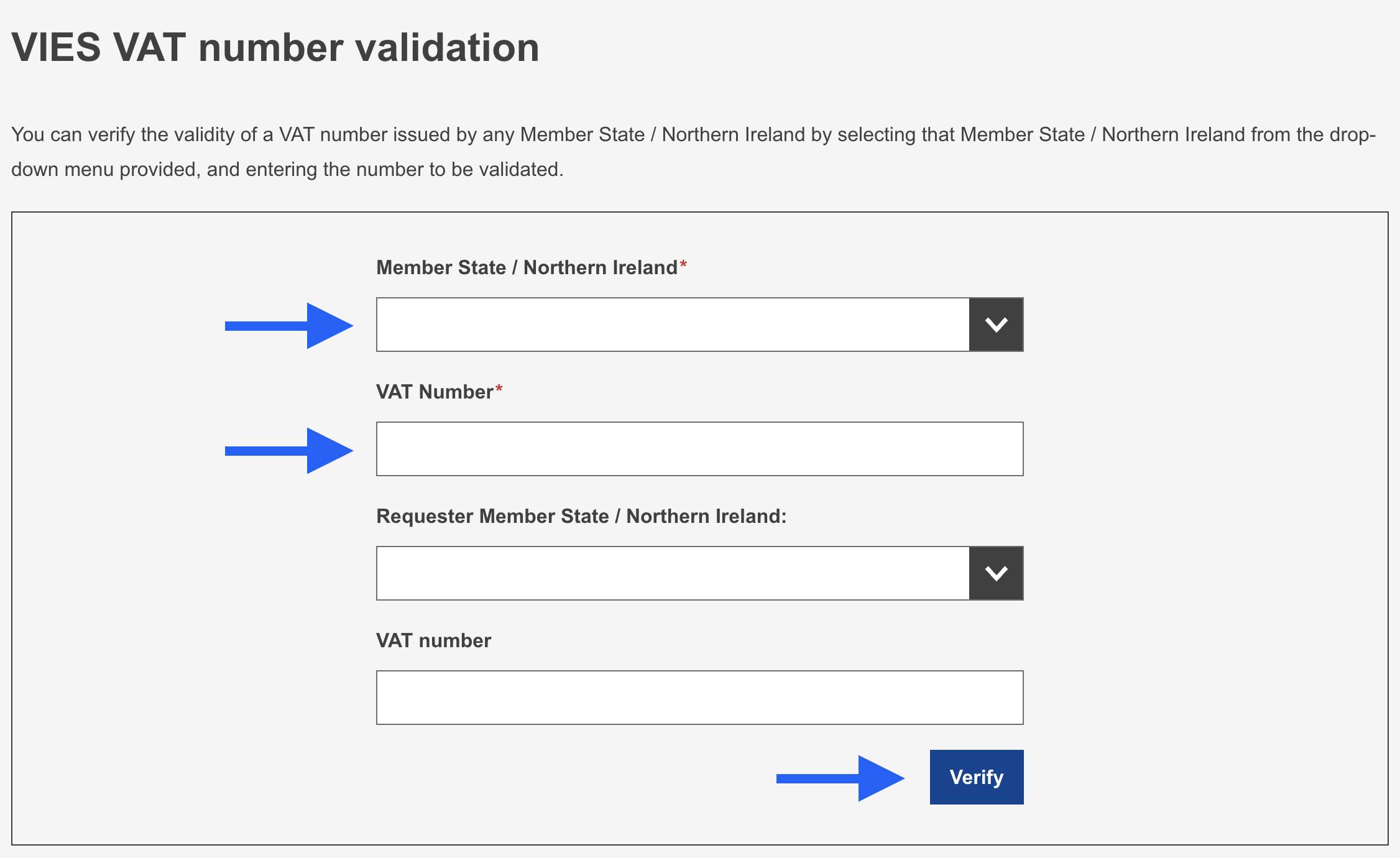

Navigate to EU VIES VAT verification website

2.

Enter data of the company you want to verify

- Select the country where the company is registered (Member State),

- Enter its VAT number,

- Click "Verify".

3.

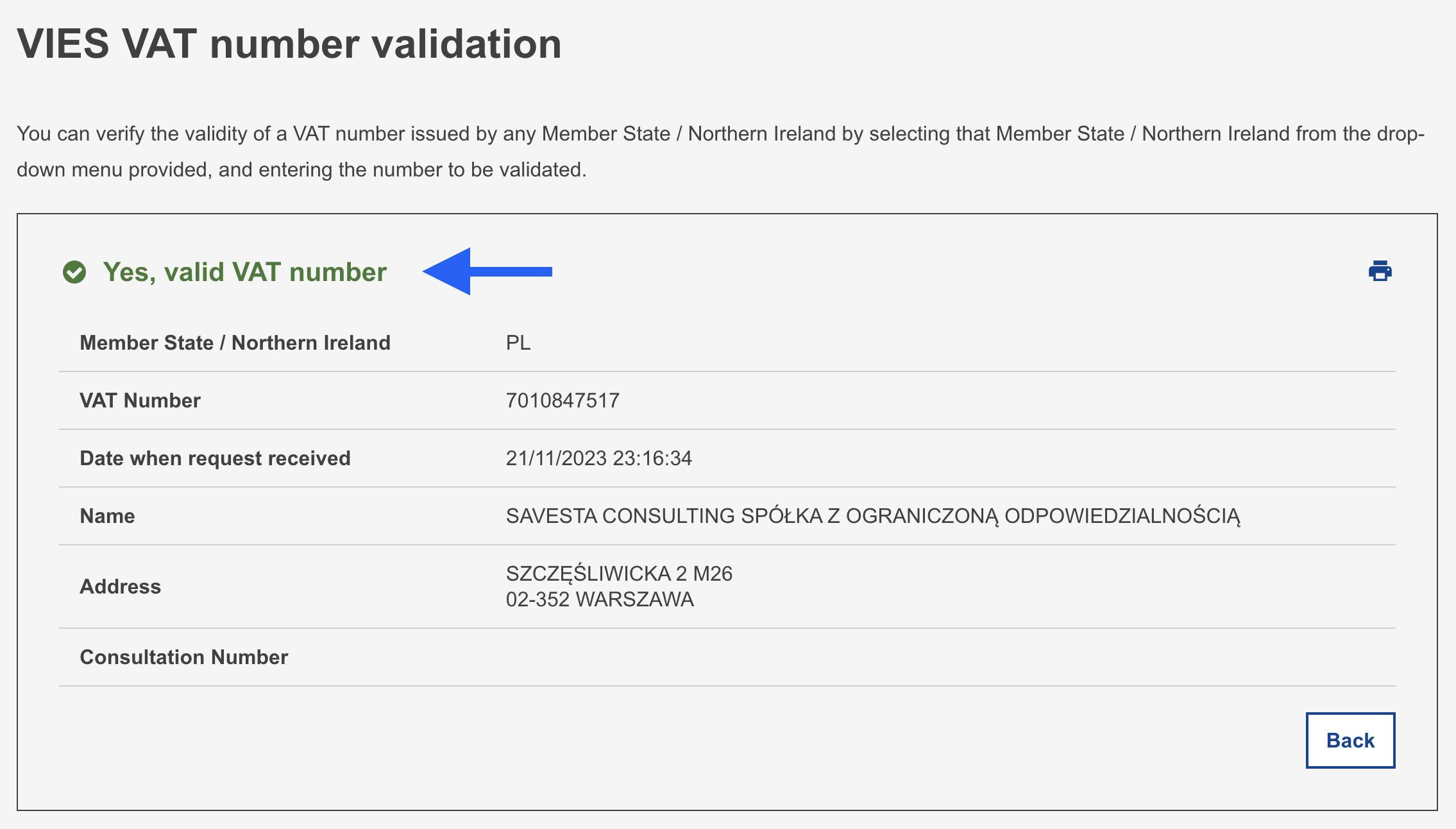

Evaluate the result

Here is how positive verification result looks like:

Great!

Now you know how to verify VAT ID using the European Union VIES VAT system!